Ira distribution tax calculator

How much are you required to withdraw from your inherited retirement accounts. 529 State Tax Calculator Learning Quest 529 Plan.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

. Use this tax calculator tool to help estimate your potential 2019 tax liability under the new plan. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. If you take a distribution of Roth IRA earnings before you reach age 59½ and before the account is five years old the earnings may be subject to taxes.

Direct contributions can be withdrawn tax-free and penalty-free anytime. And because 401ks are funded with before-tax dollars youll still have to pay taxes on anything you take out even after the age of 59 ½. See tax implications and penalty details which vary depending on your age.

If you own an Inherited IRA the RMD rules are different. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Roth IRA Distribution Details.

Compare Investments and Savings Accounts INVESTMENTS. Table III Uniform Lifetime Age Distribution Period Age Distribution Period Age Distribution Period Age Distribution Period 70 171274 82 94 91 106 42 71 163265 83 95 86 107 39 72 155256 84 96 81 108 37 73 34247 85 148 97 7. Get a clear explanation about making a Roth IRA withdrawal.

Therefore if the distribution is from a qualified plan the beneficiary should contact the plan administrator. The forms can be mailed to us at the address shown at the top of the distribution form or faxed to us at 866-468-6268. If you return the cash to your IRA within 3 years you will not owe the tax payment.

That amount is called a required minimum distribution RMD. The tax information in the calculator is not. A distribution from a Roth IRA is tax-free and penalty-free provided that the 5-year aging requirement has been.

For IRA distributions see Publication 590-B Distribution from Individual Retirement Arrangements IRAs or this chart of required minimum distributions to help calculate the required minimum distributions. Contributions for a given tax year can be made to a Roth IRA up until taxes are filed in April of the next year. Concerning Roth IRAs five years or older tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½.

With your tax advisor. You can also explore your IRA beneficiary withdrawal options based on your circumstances. IRA Contribution Calculator.

Use this calculator to determine your required minimum distributions RMD from a traditional IRAThe SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for those born after July 1. When you withdraw money from your IRA or employer-sponsored retirement plan your state may require you to have income tax withheld from your distribution. Roth IRA withdrawals can be made tax free while traditional IRA withdrawals are taxed at your income tax rate.

Repeat steps 1 through 3 for each of your IRAs. This applies to IRA accounts including SEP and SIMPLE where the owner died on January 1 2020 or. If your distribution is an eligible rollover distribution you do not have the option of electing not to have State income tax withheld from the distribution.

Minimum distribution for this year from this IRA. Government charges a 10 penalty on early withdrawals from a Traditional IRA and a state tax penalty may also apply. Once you run this calculator then you can run the current 2018 tax calculator to see if you will be paying more or less under the new plan.

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. You should discuss your situation with your investment planner tax advisor or an estate planning professional before acting on the information you receive from the Inherited IRA.

We will continually refine the calculator as more information becomes available. Learn about the rules that apply to you. So if you took 20000 from your 401k and that puts you in the 22 tax bracket you may only get about 1200013000 depending on state income tax when all is said and done.

If you simply want to withdraw all of your inherited money right now and pay taxes you can. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from TD Ameritrade. If a distribution is the result of an IRS tax levy IRS Form 5329 explains how to claim your penalty.

Calculate the required minimum distribution from an inherited IRA. 401K and other retirement plans. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD.

For instance many retirees use the 4 rule to determine income. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. You may be able to avoid a penalty if your withdrawal is for.

The Roth IRA will not require payment of taxes on any distribution after the age of 59 12. Tax-free growth potential and tax-free withdrawals in retirement. Whats your Inherited IRA required minimum distribution.

1 If you arent able to contribute to a Roth IRA because of the income limits 2 a Roth. RMD rules apply to tax-deferred retirement accounts. 529 State Tax Calculator Learning Quest 529 Plan.

Run the numbers to find out. This Inherited IRA Distribution Calculator is intended to serve as an informational tool only and should not be construed as legal investment or tax advice. How to Fill Out W-4.

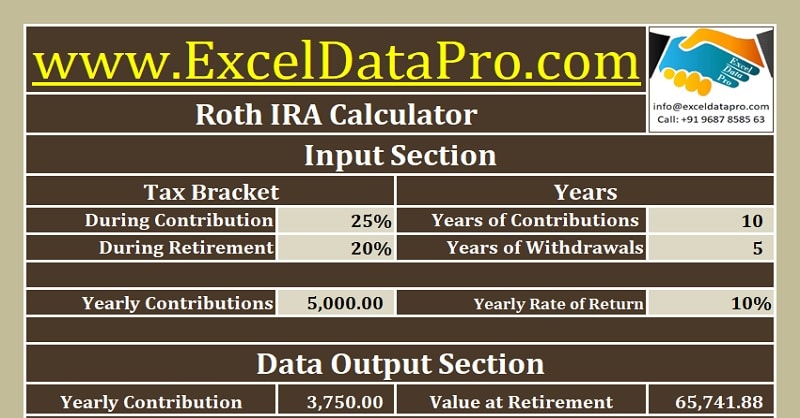

The tax benefits of a Roth IRA are clear. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you used. Finally beyond what you can withdraw from your IRA you might also want to keep in mind how much it really makes sense take out.

Most small-business accounts Keoghs Most 401k and 403b plans.

Retirement Withdrawal Calculator For Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Taxable Social Security Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Tax Calculator Estimate Your Income Tax For 2022 Free

Download Traditional Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Retirement Income Calculator Faq

Ira Growth And Distribution Calculator Retirement Planning Tool

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Tax Withholding For Pensions And Social Security Sensible Money